PPP Covered Period Start Date – Date funds were deposited.PPP Fund Remaining – How much of your PPP loan you have remaining to allocate to either operation or payroll expenses.PPP Fund Spent – This is how much of your PPP loan you have allocated to either operating or payroll expenses.Below is an explanation of each summary item. There are no values to fill in on this sheet. Please note: You can only model one year at a time. You must save two separate calculators for 20. If you qualify for the “severely financially distressed employer” benefit, change the value to 100% in the qualifying quarters (Q3 or Q4). Enter the ERTC % credit you are eligible for in 2021.Enter the number of weeks you are electing as your covered period. For PPP 2, you can choose up to a maximum of 24 weeks.Enter the start date for your PPP Term. This is the day your loan funds were deposited into your account by your bank.Enter your pay interval. Most business operate on a weekly or bi-weekly basis. So, for most, this value will be either 7 or 14.Enter in the First Pay Period of Q1. This is the first day in Q1 where funds were removed from your business checking account to pay payroll.Enter in the PPP Fund amount. This is how much you were approved for/received for the covered period you want to model.You will break the calculator and have to start over Settings and Directions Tab

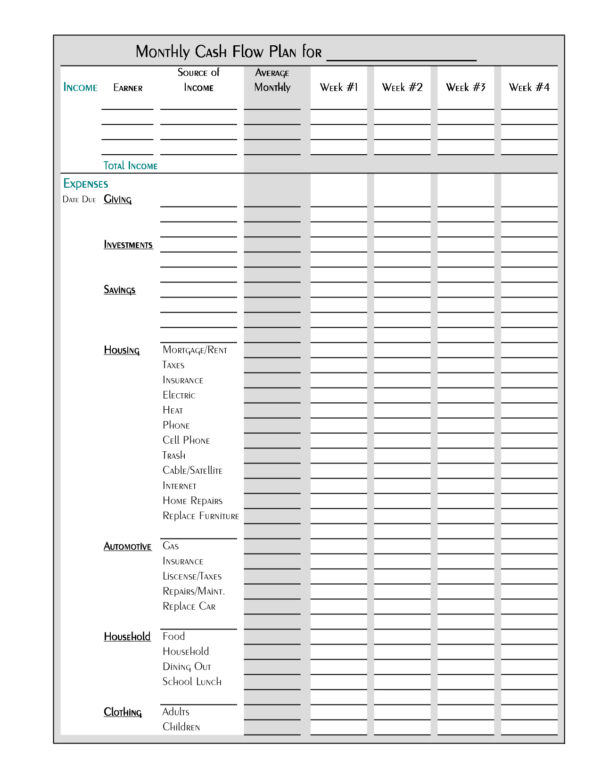

Cells in other colors contain formulas. Do not type in those areas. Most importantly, all yellow fields expect you to input a value.

0 kommentar(er)

0 kommentar(er)